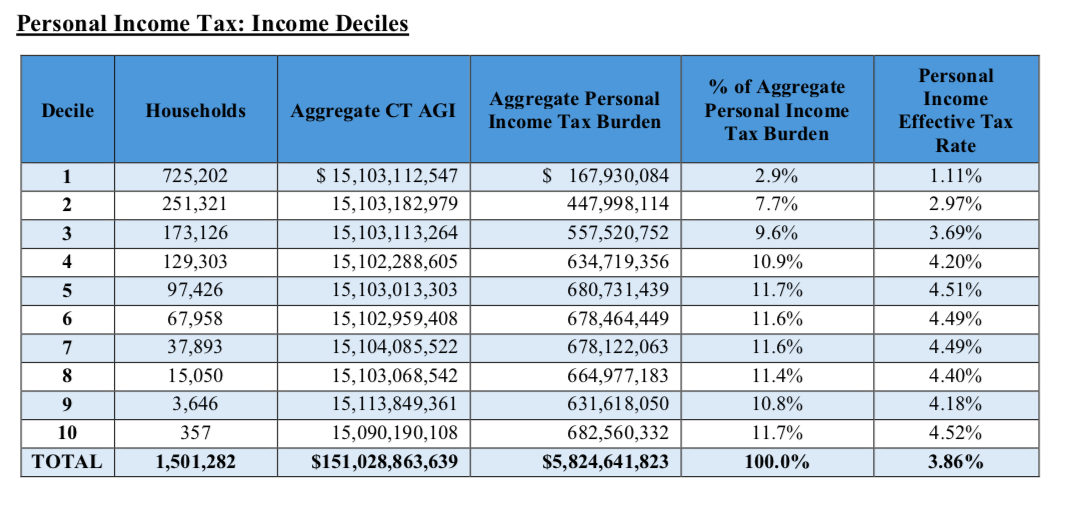

Ct Income Taxes 2025

BlogCt Income Taxes 2025. Here, you will find a comprehensive list of income tax calculators, each tailored to a specific year. Discover the connecticut tax tables for 2025, including tax rates and income thresholds.

Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income tax rates, increased earned income tax credits (eitc), and expanded senior pension exemptions. Due to rising inflation, many taxpayers and financial experts expect an increase.

Connecticut governor ned lamont has signed the state budget bill for the fiscal years 2025 and 2025, which includes a personal income tax cut;

Ct Tax Rates 2025 Dorie Geralda, Connecticut income tax brackets for 2025. You expect to owe at least $1,000 in state of ct income tax for 2025, after subtracting ct tax withholding and credits, and.

Ct Tax Due Date 2025 Aggie Arielle, What is expected from the budget 2025? Smartasset's connecticut paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Ct Tax Bracket 2025 Godiva Ruthie, Connecticut governor ned lamont has signed the state budget bill for the fiscal years 2025 and 2025, which includes a personal income tax cut; The free online 2025 income tax calculator for connecticut.

Connecticut Tax Brackets 2025 Dinnie Isabella, The current limit of rs. The free online 2025 income tax calculator for connecticut.

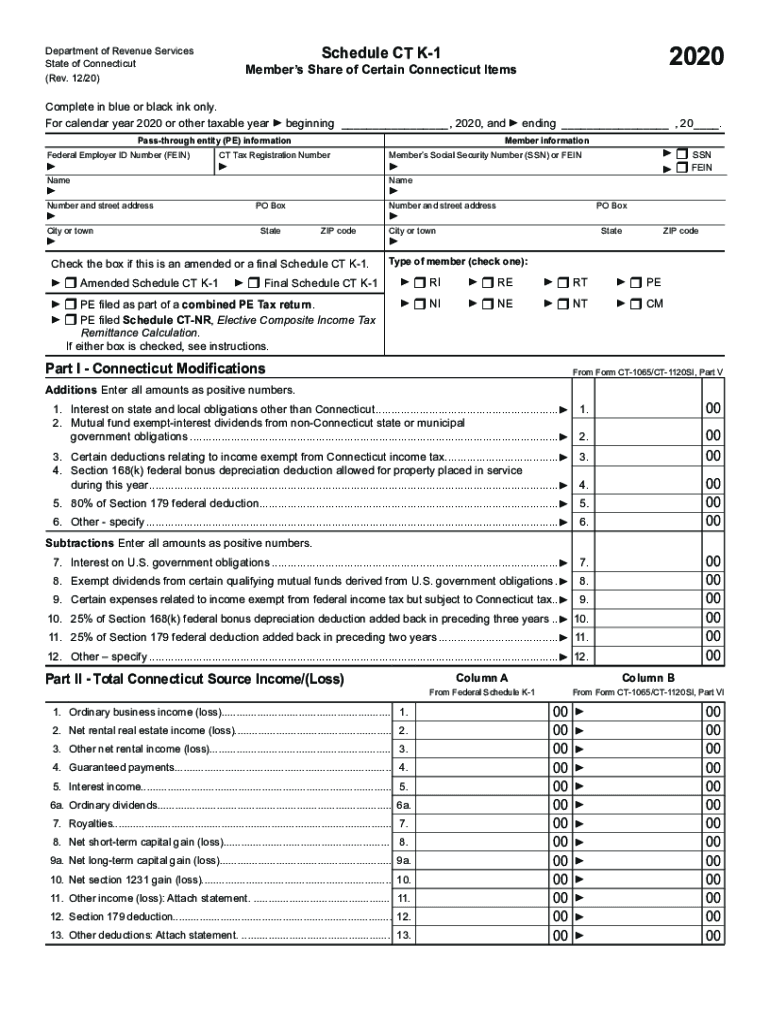

Ct K 1 20202024 Form Fill Out and Sign Printable PDF Template, Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results. The current limit of rs.

Connecticut Taxes 2025 Row Leonie, Old income tax regime individuals with a total income not exceeding ₹2.5 lakh are exempt from income tax. How can i obtain information about my connecticut tax account?

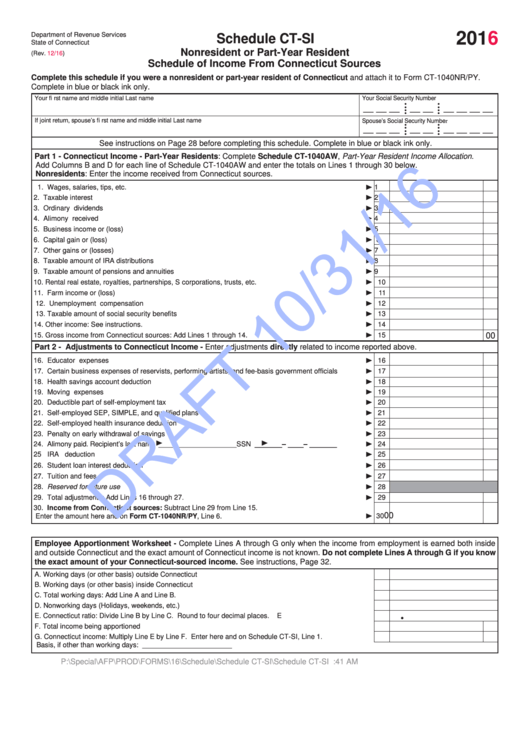

Top 224 Ct Tax Forms And Templates free to download in PDF format, Find out how much you'll pay in connecticut state income taxes given your annual income. How can i obtain information about my connecticut tax account?

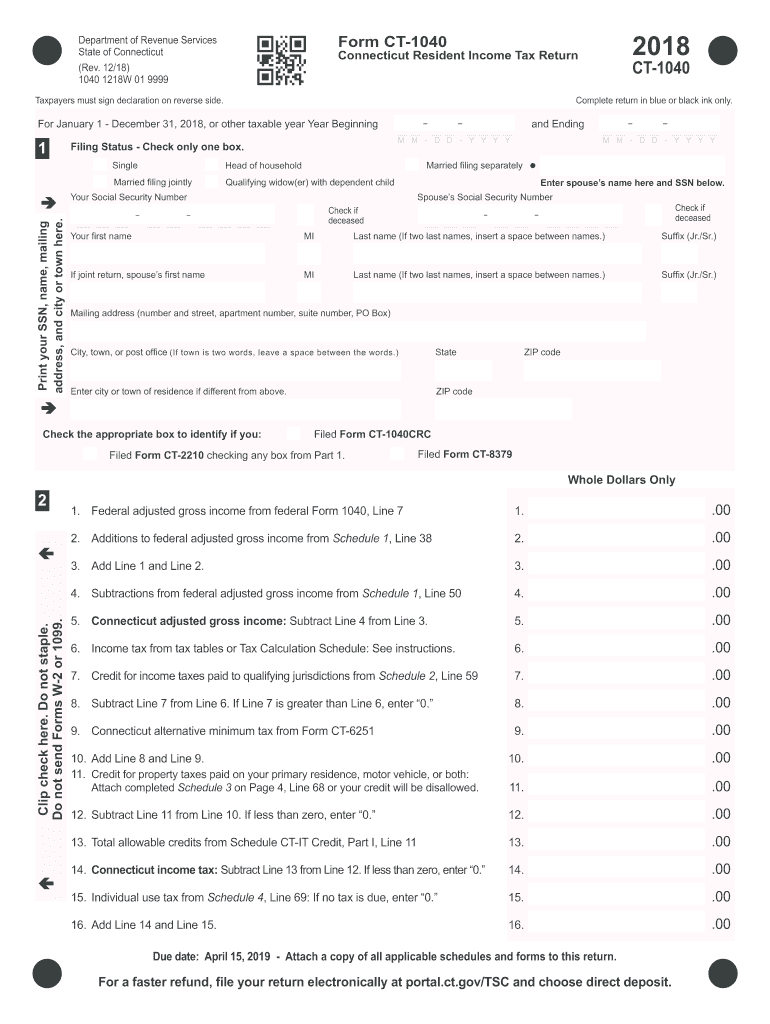

2018 Form CT DRS CT1040 Fill Online, Printable, Fillable, Blank, Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income tax rates, increased earned income tax credits (eitc), and expanded senior pension exemptions. How can i obtain information about my connecticut tax account?

ShortTerm And LongTerm Capital Gains Tax Rates By, You can generally avoid an irs penalty for underpayment of estimated taxes if you pay at least 100% of the tax shown on your return for the previous year through withholding or estimated tax payments. Select to register for the upcoming withholding tax overview webinar on wednesday, july 24, 2025, at 10:00 a.m.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Where Can I Find Tax Tables? mutualgreget, What is the income tax? Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income tax rates, increased earned income tax credits (eitc), and expanded senior pension exemptions.