Federal Tax Increase 2025

BlogFederal Tax Increase 2025. Imposes a progressive income tax where rates increase with income. Impose a minimum tax rate of 25% on the total income of individuals with wealth of $100 million or more;

At the end of 2025, nearly all of the modifications to the individual income tax system made by the 2017 tax act are scheduled to expire, and the rates will revert to. Add in some corporate tax changes and interest, and the.

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, Explore the biden budget 2025 tax proposals. The city property tax will.

T200018 Baseline Distribution of and Federal Taxes, All Tax, All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025. The pwbm lays out what individuals have to be prepared for after 2025, and the major changes will be as follows:

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, On march 11, the biden administration released its budget proposal for the 2025 fiscal year. With the sunsetting of the 199a deduction and an increase in individual federal income tax rates scheduled to occur as of december 31, 2025, the effective tax.

T220181 Distribution of Federal Payroll and Taxes by Expanded, The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Over 10 years, this expansion of the tax base would increase federal revenues by $3.5.

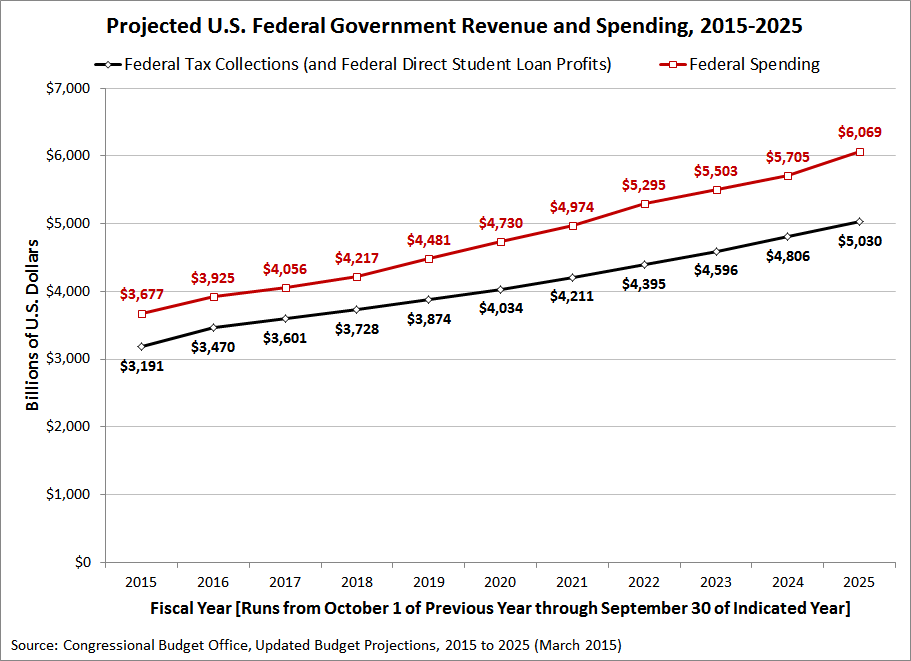

News & Blog MyGovCost Government Cost Calculator Part 2, President biden is proposing a tax increase for people making more than $400,000 a year to help finance medicare. Add in some corporate tax changes and interest, and the.

What Is Really Happening to Government Revenues LongRun Forecasts, The city property tax will. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, Impose a minimum tax rate of 25% on the total income of individuals with wealth of $100 million or more; The president’s budget would restore the expanded child tax credit, lifting 3 million children out of poverty and cutting taxes by an average of $2,600 for 39 million.

The relationship between taxation and U.S. economic growth Equitable, 10, 12, 22, 24, 32, 35, and. Through calendar year 2025, taxable ordinary income earned by most individuals is subject to the following seven statutory rates:

Raising the Corporate Rate to 28 Percent Reduces GDP by 720 Billion, 10, 12, 22, 24, 32, 35, and. At the end of 2025, nearly all of the modifications to the individual income tax system made by the 2017 tax act are scheduled to expire, and the rates will revert to.

Can We Fix the Debt Solely by Taxing the Top 1 Percent? Committee for, Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the. At the end of 2025, the individual tax provisions in the tax cuts and.