Ira Calculator 2025

BlogIra Calculator 2025. If you've inherited an ira, depending on your beneficiary classification, you may be required to take annual withdrawals—also known as required minimum distributions (rmds). Free online income tax calculator to estimate u.s federal tax refund or owed amount for both salary earners and independent contractors.

Free online income tax calculator to estimate u.s federal tax refund or owed amount for both salary earners and independent contractors. Use this calculator to create a hypothetical projection of your future required minimum distributions (rmd).

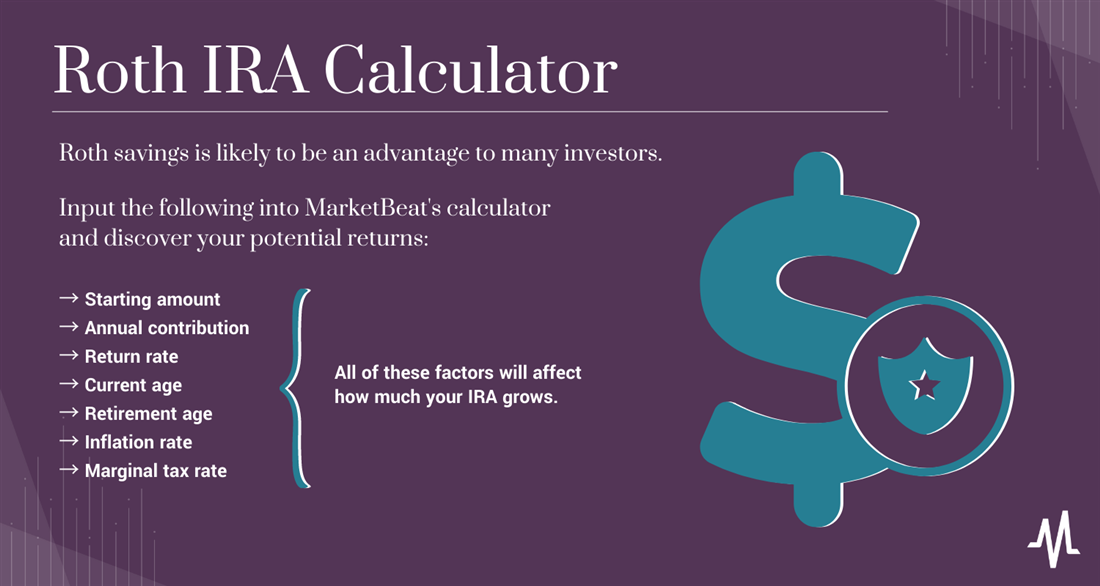

This calculator estimates the balances of roth ira savings and compares them with regular taxable account.

Roth IRA Calculator by Age How to Build Roth IRA to 1 Million YouTube, The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. This calculator has been updated for the secure 2.0 of 2025, the.

simple ira employer match calculator Choosing Your Gold IRA, Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. Use this calculator to determine your required minimum distribution (rmd) from a traditional 401 (k) or ira.

Early Withdrawal Penalty Guide 401k and IRA Penalties Calculator, The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. If your roth ira is normally invested at an average annual 10% return, which is in line with the stock market's average, and you.

Roth IRA Calculator Plan Your Retirement Savings with Ease, In general, your age and account value determine the amount. Use this calculator to create a hypothetical projection of your future required minimum distributions (rmd).

Roth IRA Calculator Calculate Your Retirement Balance, Viewers are advised to ascertain the correct position/prevailing law before relying upon any document. Bankrate.com provides a free roth ira calculator and other 401k calculators to help consumers determine the best option for retirement savings.

Download [Free] Traditional IRA Calculator in Excel, Single, head of household or married filing separately (and you didn't live with your spouse at any point during 2025) yes, if your income is less than $146,000. Viewers are advised to ascertain the correct position/prevailing law before relying upon any document.

![Download [Free] Traditional IRA Calculator in Excel](https://exceldownloads.com/wp-content/uploads/2022/05/Traditional-IRA-Calculator-in-Excel-by-ExcelDownloads.png)

IRA Retirement Calculator Forbes Advisor, Use our rmd table to see how much you need to take out. Use this calculator to determine your required minimum distribution (rmd) from a traditional 401(k) or ira.

Nerdwallet Roth IRA calculator results explained (with examples) (2025, The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. Use this calculator to determine your required minimum distribution (rmd) from a traditional 401(k) or ira.

Precious Metals IRA Calculator Retirement Investments, In general, your age and account value determine the amount. The income tax calculator helps in determining tax payable for a financial year.

These Life Expectancy Tables 2025 By Country In 2025 Mismatched, The income tax calculator helps in determining tax payable for a financial year. The changes begin with the inflation adjustments for various medicare.

Single, head of household or married filing separately (and you didn’t live with your spouse at any point during 2025) yes, if your income is less than $146,000.