Roth Contribution Limits 2025 Salary Limit

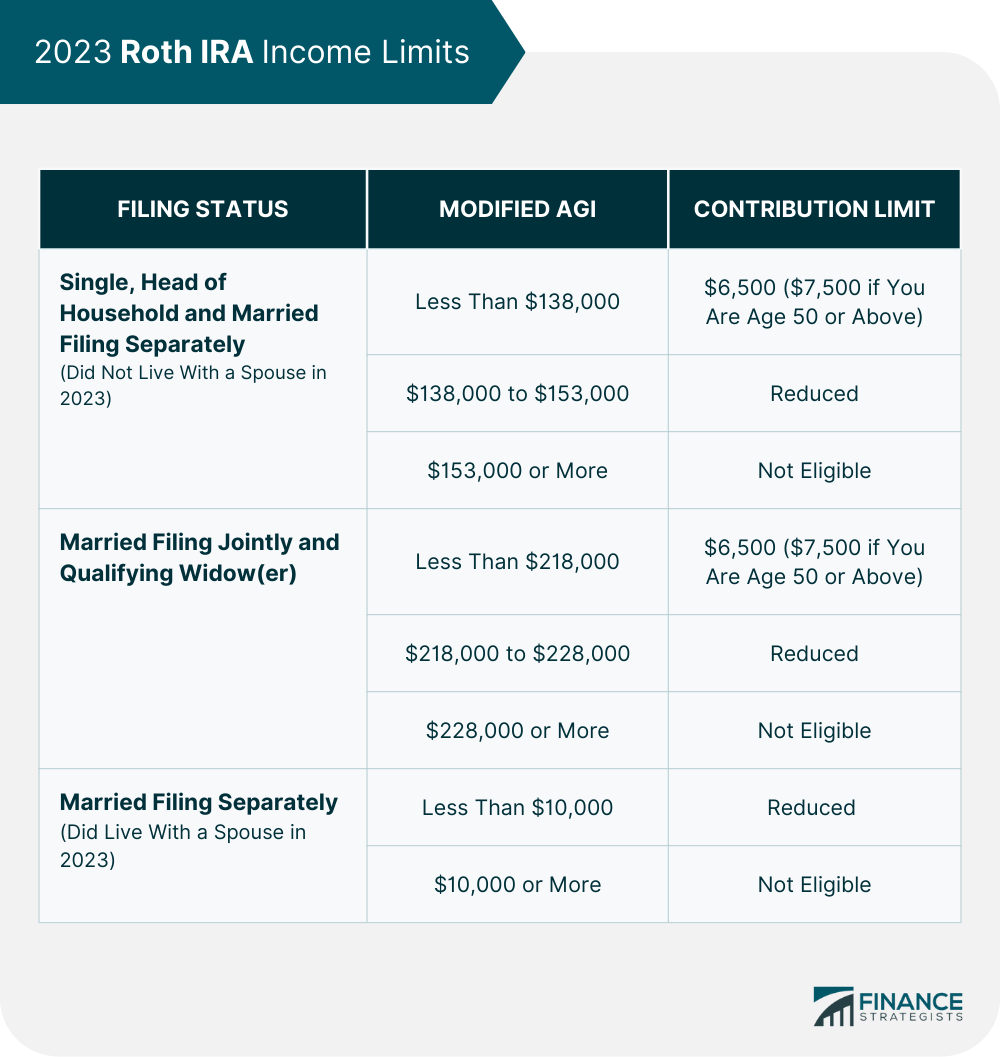

BlogRoth Contribution Limits 2025 Salary Limit. Married filing jointly (or qualifying widow(er)) less than $230,000 $7,000 ($8,000 if age 50 or. In 2025, you can contribute up to $7,000.

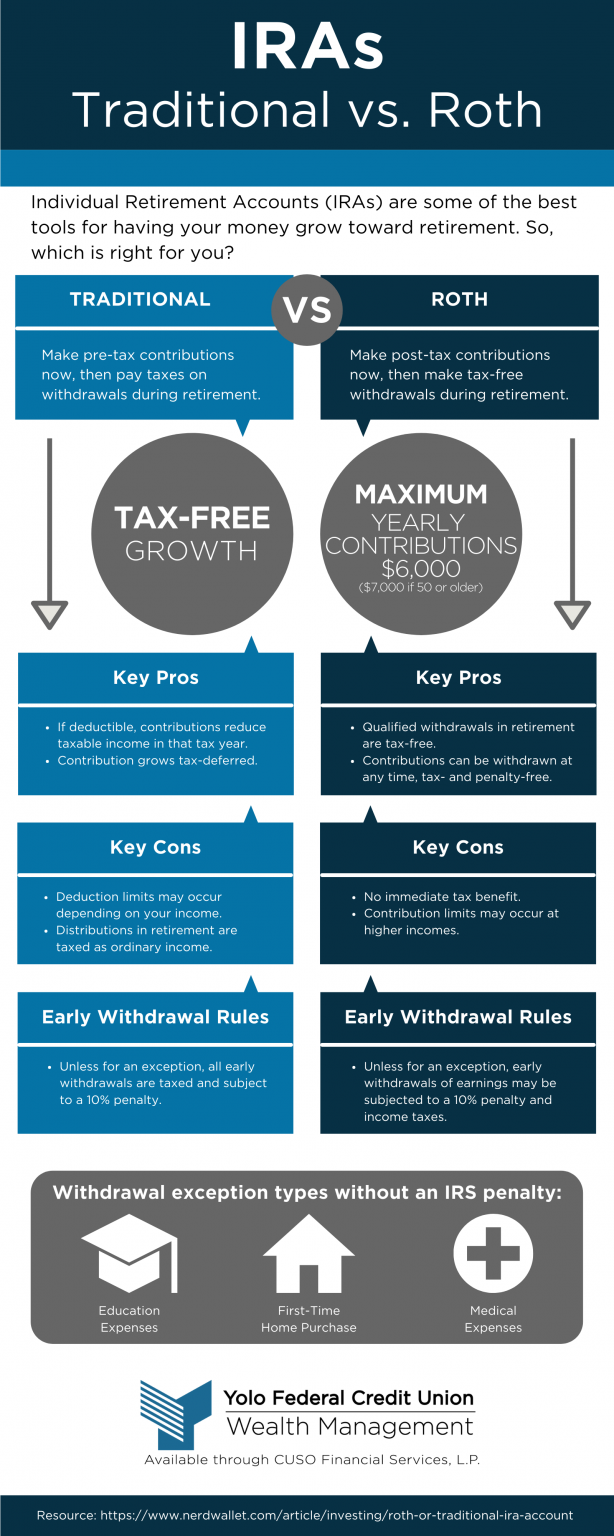

For 2025 and 2025, you can contribute up to $7,000 annually to your roth ira. However, keep in mind that your eligibility to contribute to a roth ira is based on your income.

Roth 401k Salary Limits 2025 Tedda Gabriell, The roth ira income limits will increase in 2025.

Roth Ira Limits 2025 Salary 2025 Bell Marika, Unlike the tax rate which has been at 6.2% for employees since 1990, the tax limit, also known as the taxable maximum, changes every year.

Roth Ira Limits 2025 Joint Olive Ashleigh, For 2025 and 2025, you can contribute up to $7,000 annually to your roth ira.

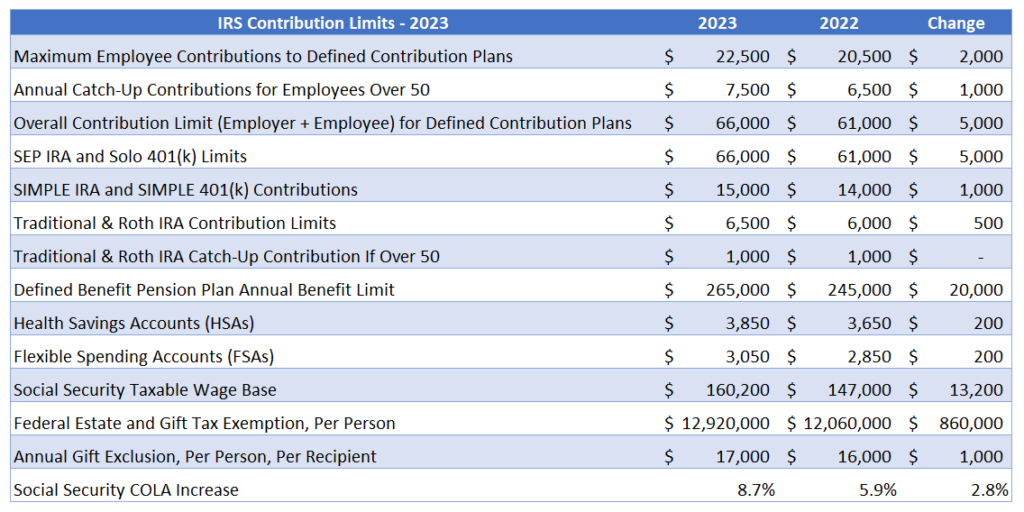

Roth Ira Limits 2025 Salary Requirements Vally Isahella, The 2025 401(k) contribution limit increased to $23,500, up from $23,000 in 2025.

Roth Ira Contribution Limits 2025 Salary Cap Calculator Emyle Isidora, What are roth ira contribution limits?

Roth Ira Limits 2025 Salary Pearl Beverlie, Unlike the tax rate which has been at 6.2% for employees since 1990, the tax limit, also known as the taxable maximum, changes every year.

Roth Ira Limits 2025 Salary Requirements Vally Isahella, However, keep in mind that your eligibility to contribute to a roth ira is based on your income.

Roth Ira Contribution Limits 2025 Salary Cap Alexa Prisca, Discover the roth ira contribution limits for 2025, and how they can impact your retirement savings.

Roth Ira Limits 2025 Over 65 Karol Martita, However, keep in mind that your eligibility to contribute to a roth ira is based on your income.