Traditional Ira Income Limits 2025 Single

BlogTraditional Ira Income Limits 2025 Single. The total contribution limit for iras in 2025 is $7,000. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. Ira contribution limit increased for 2025.

ira contribution limits 2025 Choosing Your Gold IRA, Updated on december 22, 2025. With the passage of secure 2.0 act, effective 1/1/2025 you may also be eligible to contribute to.

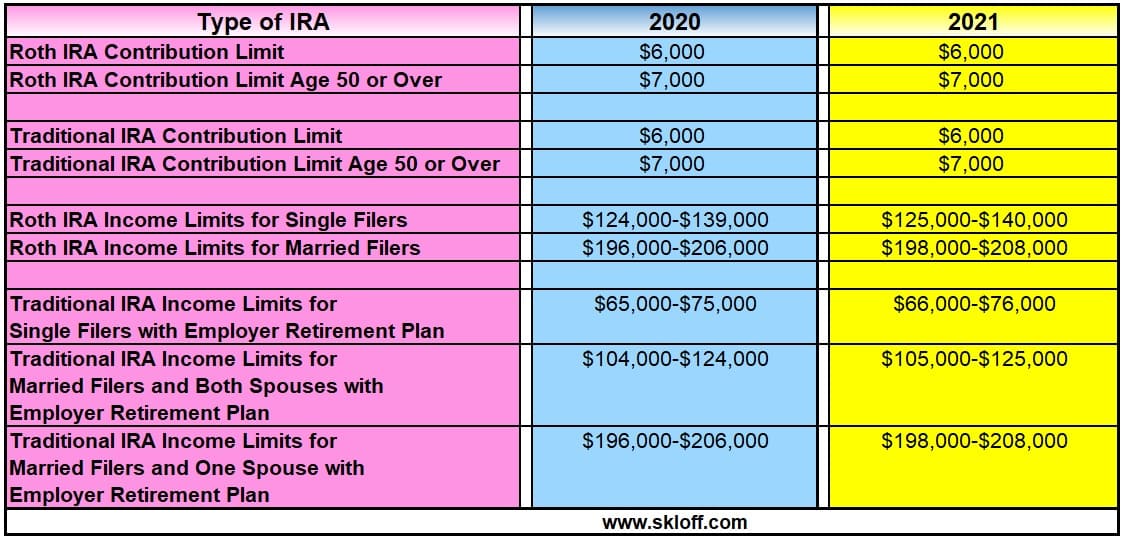

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. The annual contribution limit for a.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, While there are no income limits for contributing to a traditional ira, there are income limits for deducting your contributions on your tax. The 2025 traditional ira income limits are as follows:

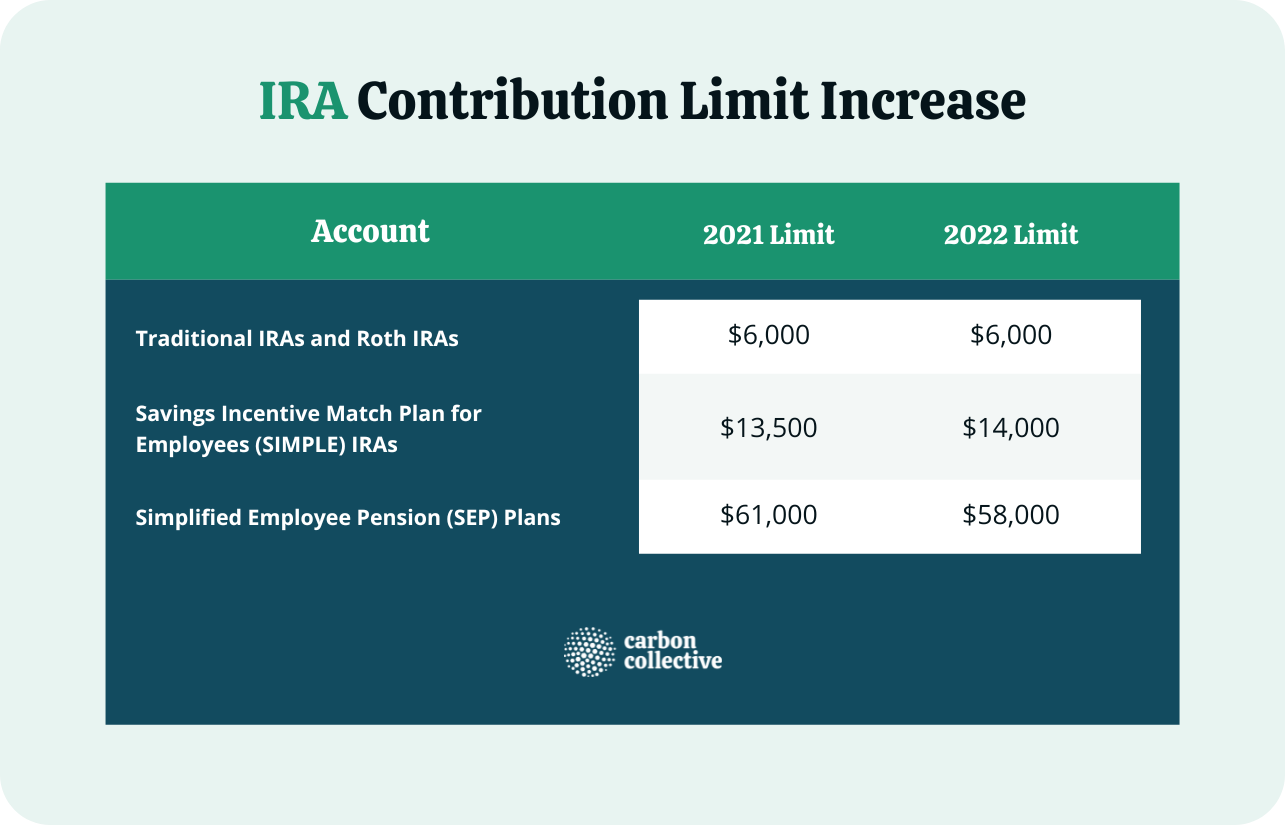

IRA Contribution Limits in 2025 & 2025 Contributions & Age Limits, 401 (k) limit increases to. $6,500 (for 2025) and $7,000 (for 2025) if you're under age 50.

IRS Unveils Increased 2025 IRA Contribution Limits, The income ranges on iras are. Written by lauren perez, cepf®.

2025 Traditional and Roth IRA and Contribution Limits, Traditional ira contribution limits for 2025. For tax year 2025, savers can defer paying income tax on an ira contribution up to $7,000 for those under 50, and $8,000 for those age 50 and older.

Traditional Ira Limit 2025 Tami Zorina, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Find out if you can contribute and if you make too much money for a tax deduction.

Top 10 traditional ira limits 2025 2025, For 2025, you can contribute up to $7,000 in your ira or $8,000 if. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

traditional ira limits Choosing Your Gold IRA, If your modified gross adjusted income. Income tax on this money.

Traditional IRA Limits What You Need to Know, This figure is up from the 2025 limit of $6,500. The irs announced the 2025 ira contribution limits on november 1, 2025.

In 2025, single filers making less than $161,000 and those married filing jointly making less than $204,000 are eligible to.